We have written extensively on the trade tensions and the US-China trade war in particular. Our optimism early last year turned to pessimism as tensions escalated over the summer and the US labelled China a “currency manipulator”.

Progress towards a “Phase 1” deal first hit the headlines in early October when the US cancelled a planned increase in tariffs in return for Chinese commitments to purchase more US goods and agricultural commodities in particular. Further progress was made in December, when the US cancelled another planned increase in tariffs and lowered some tariffs from 15% to 7.5%. More recently, on 13 January the US removed the “currency manipulator” label from China ahead of the planned official signing of the Phase 1 deal on 15 January.

The US Treasury Department undertakes a semi-annual review of “Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States”. The review defines three criteria to “consider whether countries manipulate the rate of exchange between their currency and the United States dollar for purposes of preventing effective balance of payments adjustment or gaining unfair competitive advantage in international trade.”

Here we consider the three criteria and put China’s progress into context by looking at how they have evolved over time.

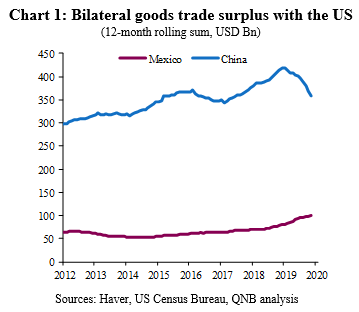

The first criterion is whether the country has a significant bilateral goods trade surplus with the US. The US reports that China had a goods trade surplus with the US of USD 401 Bn in the 12 months to June 2019. That is around four-times larger than Mexico’s surplus, which is the next highest (see Chart 1). It is also clearly above the USD 20 Bn threshold set by the US Treasury Department.

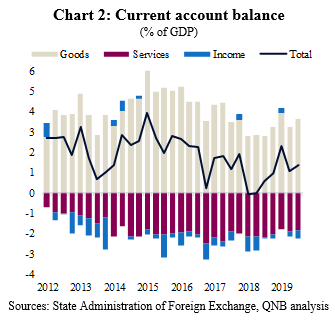

The second criterion is a material current account surplus. China’s current account surplus widened from 0.4% of GDP in 2018 to 1.2% of GDP (USD 88 Bn) in the first half of 2019 (see Chart 2). Slower Chinese GDP growth reduced both goods and services imports, particularly outbound tourism. Whereas, Chinese goods exports have remained steady, which has resulted in a widening goods surplus despite a continued deficit in services. Despite the widening goods surplus, China’s current account surplus remains below the 2% threshold set by the US Treasury Department.

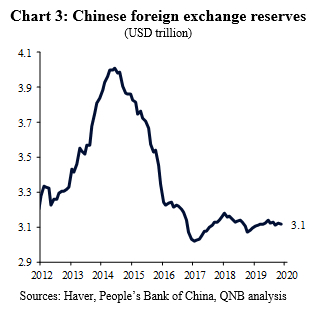

The third criterion is whether a country engages in persistent one-sided currency intervention. China does not publish data on currency intervention and manages the exchange rate using a range of tools. However, official Chinese foreign exchange reserves are broadly unchanged at around USD 3.1 trillion (See Chart 3). Therefore, the US judges that the Chinese have “refrained from intervention” in the past year.

So, in conclusion, the Chinese have been careful not to intervene and cause the Renminbi to depreciate (Chart 3), which has allowed China’s bilateral trade surplus with the US to ease back (Chart 1), despite the Chinese current account surplus picking back up (Chart 2). Taken together this means that China only meets one of the of US’s three criteria, allowing the US to remove the “currency manipulator” label from China ahead of the planned official signing of the Phase 1 deal on 15 January.

Progress towards the Phase 1 deal means that the headwind for Global GDP growth from the US-China trade war appears to be abating. Therefore, our assessment of the balance of risks to the global economic outlook has shifted. That is not to say that downside risks have gone away, rather we judge that global GDP growth is now more likely to be slightly above the base case, rather than slightly below. Before the Phase 1 deal, our view was that growth was more likely to be slightly below the base case rather than slightly above

Download the PDF version of this weekly commentary in English or عربي