What is (L)IBOR?

Interbank Offered Rates (IBORs) are benchmark interest rates that are intended to represent the cost of short-term, unsecured, wholesale borrowing by large international banks. LIBOR, the London Interbank Offered Rate, is the most widely used interest rate benchmark in the world.

LIBOR is determined by a bank survey administered by the Intercontinental Exchange (ICE). Every business day, ICE asks a panel of about a dozen contributing banks the rate at which they can fund themselves in various tenors up to one year in five currencies: the Swiss franc (CHF), euro (EUR), British pound (GBP), yen (JPY) and U.S. dollar (USD). ICE then collates the results, eliminates the top 25% and bottom 25% of submissions, and averages the remainder to arrive at the published LIBOR.

What is the IBOR Transition?

There are concerns about the level of subjectivity involved in the LIBOR submissions. The size of the interbank lending market is typically less than $1 billion a day – tiny compared to the size of the market that uses LIBOR resets, which exceeds $200 trillion. The small size of the London interbank lending market, the limited number of contributors and the fact that LIBOR is often not backed by transactional data have led regulators to look for a more robust benchmark rate.

In 2013, following accusations of rate rigging by certain contributing banks, the G20 asked the Financial Stability Board (FSB) to undertake a fundamental review of major interest rate benchmarks. This work led to the realisation that declining transaction volume in the markets that underpin IBORs undermined this as an approach to setting a representative and robust benchmark.

In 2017, the Financial Conduct Authority (FCA; the UK body that regulates LIBOR) declared that after 31 December 2021 it will no longer compel banks to continue making LIBOR submissions. As a result, the market has been primed to expect that LIBOR publication may cease entirely, and the process to determine alternate benchmarks commenced.

On the 5th March 2021, the FCA announced the formal cessation of all 5 LIBOR currencies and their tenors on a defined future date. For GBP, EUR, CHF, JPY and some minor USD tenors, the last expected publication will be 31st Dec 2021. For the remaining core USD tenors including 1 and 3 month, these will be published for the last time on the 30th June 2023.

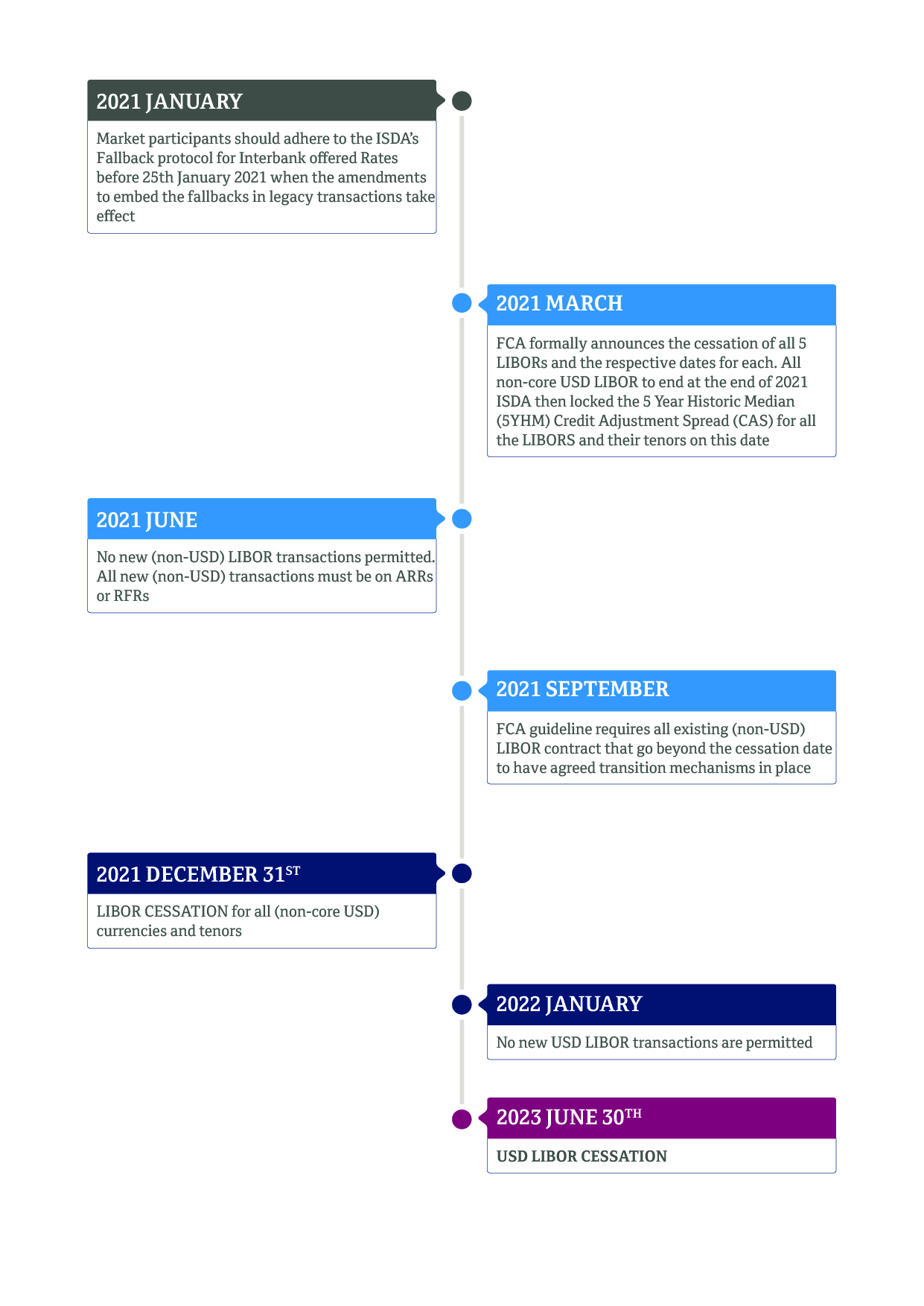

What is the LIBOR transition timeline?

The below provides a high-level overview of milestones that have been or are expected to be completed as the IBOR Transition moves forward:

What will IBORs be replaced with?

The primary recommended benchmarks are considered nearly risk free and specifically referred to as Risk Free Rates (RFR). The table below lists the RFRs for some of the major currencies.

|

Currency |

RFR |

Secured? |

Publication time |

|

Sterling (£) |

SONIA (Sterling Overnight Index |

N |

09:00 GMT T+1 |

|

Euro (€) |

ESTER (Euro Short-Term Rate) |

N |

09:00 CET T+1 |

|

US Dollar |

SOFR (Secured Overnight |

Y |

08:00 ET T+1 |

|

Swiss Franc |

SARON (Swiss Average Rate |

Y |

12:00, 16:00 and 18:00 CET same day |

|

Japanese Yen |

TONA (Tokyo Overnight Average Rate) |

N |

10:00 JST T+1 |

What is a LIBOR fallback?

It is anticipated that over the next years, LIBOR and potentially various other IBORs will be discontinued. To address the risk that counterparties may have exposure to a discontinued IBOR, they are encouraged to agree to contractual fallback provisions. Such provisions set out the broad principles (or in some cases, the detail) underlying the approach the counterparties would take in replacing references to LIBOR in loan and other financial products’ contracts.

What is the difference between LIBOR and the new benchmarks?

IBORs differ from RFR’s in several very important ways:

- IBORs are forward looking term rates, known and set at the beginning of an interest period. In contrast, ARRs are overnight interest rates.When used to set a rate for an interest or coupon period, an observation will be taken each day (possibly adjusted for lookback days) and a compound average calculated. A significant consequence of this approach is that the final rate will not be known until the end of the coupon period – a few days before payment is due.

- IBORs include a credit spread or margin, as they represent unsecured bank credit risk. ARRs, on the other hand, include little or no credit risk, as they are very short-term rates (overnight) and in some cases, secured.

- A key driver of suitability for regulators is that the rate should be able to be evidenced by actual transactions, and hence are not subjective or judgement based. The ARRs were selected in large part due to the volume of transactions that occur daily in the markets underpinning these rates.

LIBOR

New Benchmark

Based on panel bank

quotes for unsecured

interbank term lending (IBOR)Nearly risk free rate (RFR),

secured overnight rate based on transactionsForward looking rate

(fixed in the beginning of the period)Backward looking, compounding in

arrears, interest is calculated at the

end of the periodAlready contains credit risk

and liquidity premiumTerm and spread adjustments

are requiredHas a term structure

(1, 3, 6 month LIBOR)Not all new benchmarks have

a term structure only overnight

What is the Credit Adjustment Spread (CAS) and why is it needed?

Since RFRs are structurally different from IBORs, a credit adjustment spread is required to preserve the economic value of the contracts between bank and client. The CAS levels for each currency and tenor are fixed for each facility at the point of transition and is applied to the remaining term of the facility in addition to the agreed replacement rate.

The credit adjustment spread itself exists to account for the missing credit/counterparty risk absent in ‘risk free rates’ given the fact that an RFR is an overnight rate expected to be repaid the next day while IBORs have term structures (e.g., 1, 3, 6-month LIBOR).

ISDA announced that Bloomberg will be the adjustment services vendor for IBOR fallback calculations. Consequently, Bloomberg publishes the term and spread adjustments for the fallbacks that ISDA implements for certain IBORs.

The calculations are based on the methodology developed by ISDA through a series of market consultations, and can be viewed on ISDA’s website, however this approach is widely adopted for cash products in the marketplace.

What is QNB’s approach to LIBOR transition?

QNB has established a Global LIBOR transition programme, which is responsible for coordinating and directing the actions of the business in migrating away from LIBOR-based product pricing. The programme affects all aspects of QNB’s businesses (Sales, Product Development, Treasury, Operational, Finance, Risk, IT etc.) across multiple jurisdictions. The challenge includes the development of new products and operational processes, upgrade of the Bank’s systems, legal contract remediation and the migration of legacy products onto RFR’s in a controlled and ordered manner.

I am a QNB client. How will the IBOR Transition impact me?

We are engaging with our impacted clients relative to the timeline of IBOR cessation. If you have existing non-USD impacted facilities you will have been contacted already. If you have outstanding questions on these facilities please contact your Relationship Manager as soon as possible.

If you have existing USD LIBOR impacted facilities we will be contacting you in the coming months and outlining to you the route to transition and maintain a functioning facility as intended at inception.

In the meantime, we recommend that you periodically monitor the news emerging from the relevant trade bodies and consider the potential impact on your products. Other actions that you may consider undertaking are:

- Review your existing contracts to identify IBORs related transactions.

- Consider what actions need to be taken to ensure operational & system readiness, whether external support will be required, and the time required to ensure preparedness.

- Consider whether the applicable timescales work in relation to those dictating market changes.

- Seek independent financial, legal and or tax advice as you see fit.

If you require further information on specific QNB products and services, including those to which you may have exposure, or if you have a more urgent need to change your LIBOR facilities, please contact your sales representative or relationship manager.

How do I monitor developments?

The following websites regular feature developments as they occur. Large legal firms involved in the financial industry also often publish articles and may provide advice. Other jurisdictions not mentioned below may find information pertinent to their market on the regulator’s website.

|

Country |

Entity |

Link |

|

United States |

ARRC – The Alternative |

|

|

United Kingdom |

The Bank of England |

|

|

FCA – The Financial Conduct Authority |

||

|

Europe |

The European Central Bank |

|

|

Global Trade Bodies |

ISDA – The International Swaps |

|

|

LMA – The Loan Market Association |

||

|

LSTA – Loan Syndications and |

Disclaimer

Whilst we have taken measures to ensure the above is accurate and up-to-date, QNB Group does not accept any liability for any loss or damage caused to any person. Further, the above may contain references to certain laws and regulations. Laws and regulations will change over time and should be interpreted only in light of particular circumstances. Finally, the above is provided for information purposes only and should not be relied upon as offering advice under any circumstances. QNB Group recommend that you should obtain legal, tax, accounting, financial or any other professional advice or services for your specific needs.