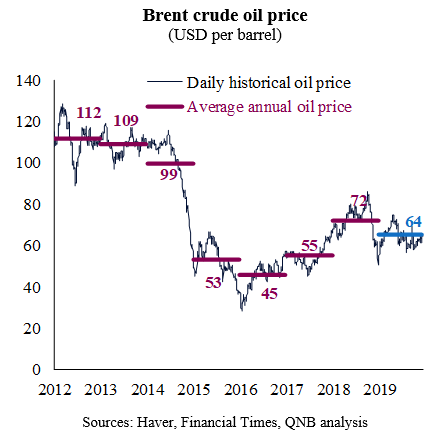

The oil price story in 2019 was dominated by a plethora of cross-currents coming from both global macro and industry specific events. On the bearish side, the global manufacturing slump, demand fears associated with US-China trade conflicts and continuous robust growth in US shale production placed downward pressure on prices. On the bullish side, geopolitical disruptions in oil exporting nations and active supply management from OPEC+ countries provided some support to prices. On balance, however, bearish forces prevailed, pushing average Brent crude prices down to USD 64 per barrel (/b) so far this year from USD 72/b in 2018.

Moving forward, while Bloomberg consensus forecasts suggest further oil market weakness with Brent prices sliding down to average USD 61/b in 2020, we hold a different position. In our view, Brent prices are expected to remain well supported at around the current levels of USD 65/b, with the balance of risks skewed to the upside, i.e., we believe higher prices are more likely in 2020 than lower prices. Our view on crude prices is underpinned by three main factors.

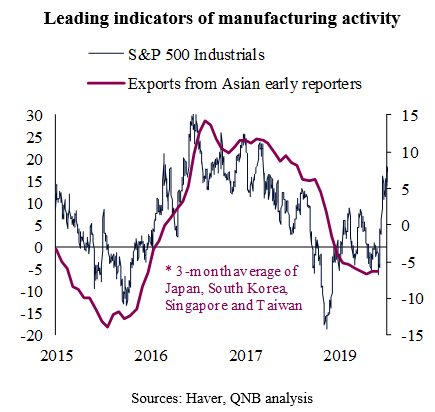

First, current market expectations about oil demand growth are overly-bearish and do not fully incorporate the upcoming turn of the global manufacturing cycle towards another expansion. Early signs of a manufacturing rebound are starting to flash as key leading indicators improve, including Purchasing Managers’ Indices (PMIs), equity prices of manufacturing companies and even some pockets of international trade activity. This should be further supported by the lagged effects of both monetary and fiscal policy easing in large advanced and emerging markets. Importantly, base metals prices (high-grade copper and the London Metal Exchange Index), which lead oil prices and emerging market GDP growth, have soared in recent weeks.

Second, current market expectations about oil supply growth are too optimistic, assuming continuous robust growth in US shale output and less discipline in the execution of OPEC+ quotas. Despite the strong performance of US shale output in recent years, fresh investor demand for greater capital discipline is already affecting invenstments, which suggests slower shale growth. In addition, OPEC+ countries have decided last week to cut production by another 500k barrels of oil per day, reinforcing their commitment to a balanced physical market. Moreover, OPEC+’s mechanisms to enforce accountability and quota compliance were strengthened, enhancing the overall credibility of the strategy.

Third, while global economic uncertainty is likely to persist, problems surrounding US-China trade disputes are expected to temporarily subside under a potential “Phase 1” agreement. Global risks are expected to be replaced by US election risks in 2020. For oil prices, in particular, this is a positive development. Positive global sentiment from less trade uncertainty should prop up investor risk appetite, supporting commodity prices in general. In addition, the US election may increase the regulatory uncertainty over the domestic oil industry, especially as key candidates question the environmental effects of shale activities. This uncertainty can potentially prevent new investments in exploration and production, constraining future output growth.

All in all, we believe global macro conditions, policy easing, industry-specific developments and shifts in risk sentiment are set to create a strong support for Brent prices at around the current USD 65/b level in 2020. In this context, the balance of risks is also tilted to the upside, as positive growth surprises and negative supply shocks are at this juncture more likely than other opposite scenarios.

Download the PDF version of this weekly commentary in English or عربي