The Federal Reserve (the Fed) unanimously agreed to an emergency cut of their policy rate by 50 basis points (bp) to a range of 1.0% - 1.25% on 3rd March. This was perhaps an attempt at a “shock and awe” policy announcement, like the co-ordinated interest rate cuts by six major global central banks in response to the 2008 global financial crisis.

However, the market response was far from positive, with stock markets falling by nearly 3% despite the yield on 10 year Treasuries falling below 1% for the first time. Markets may have reacted badly because the Fed moved alone rather than co-ordinated multilateral action. Indeed, a recent conference call of G7 finance ministers concluded by pledging action to be taken individually by each nation.

The statement accompanying the emergency Fed cut was remarkably brief, making two main points: “The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity.” We will now discuss these two main points before noting the implications for monetary and fiscal policy around the world.

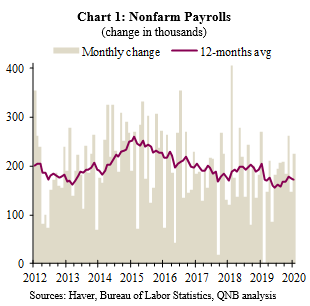

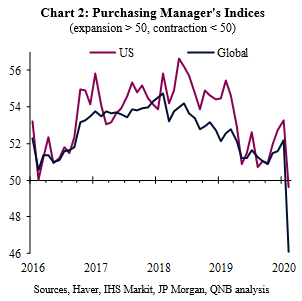

In contrast to the Fed, our view is that economic momentum was dissipating even before the impact of the virus. This was mainly as a result of a maturing labour market and firms remaining cautious about committing to hiring and investment. With the unemployment rate at multi-decade lows, hiring activity has softened over the past 12 months (Chart 1). Also, leading indicators for real domestic activity have weakened, with the February PMI in contractionary territory at 49.6 (Chart 2). Business investment contracted by 1.5% in Q4, declining for a third consecutive quarter, as slower global growth, lingering trade tensions, and policy uncertainty continued to take their toll.

The United States has arguably been one of the countries least impacted by the virus relative to the size of the economy and population, with only 117 confirmed cases and 7 deaths reported so far. However, it is becoming increasingly clear that the virus is a major headwind for the whole global economy as indicated by the sharp fall in the Global PMI (Chart 2). Indeed, global financial markets have now really woken up to risk, including to corporate earnings and commodity demand, posed by the virus.

The Fed has a clear mandate to support both US employment and price stability. The virus had already weakened the outlook for both global growth and asset prices, which will act as further headwinds for the US economy and would have push down on employment and inflation in the US without a policy response from the Fed.

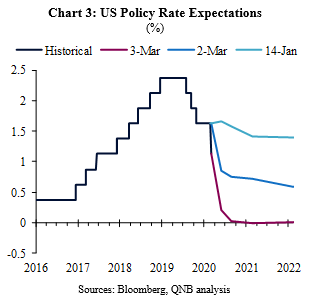

The emergency rate cut implies a significant and rapid deterioration of the outlook as the Fed had unanimously agreed to hold at its January meeting and effectively adopted a ‘wait-and-see’ stance. Indeed financial markets went from pricing in no change to policy rates two weeks before the January meeting to fully pricing in a 50bp at the March meeting just before the emergency rate cut (Chart 3). Markets now expect a further 50bp cut at the March meeting and a cut to zero by the middle of 2020.

It is clear from the G7 statement that finance ministers and central bank governors are beginning to take the virus more seriously. Hiking interest rates aggressively in 2017 and 2018 gave the Fed policy space, which it is now using to lead the global economic policy response to the virus in the absence of co-ordinated multilateral action. Lower US interest rates will encourage and enable other central banks to also lower interest rates to avoid currency appreciation. And, as we have argued, lower interest rates provide governments with more space to engage in fiscal stimulus.

The virus is a tough challenge for policymakers because it hits both the supply side and demand side of the economy. Monetary policy is certainly no panacea and has arguably become less effective. Nevertheless it still has an important role to support demand and confidence in these difficult times.

Download the PDF version of this weekly commentary in English or عربي