At the start of the year, global growth appeared to have bottomed out and our expectation was for a modest rebound to be driven by significant monetary stimulus and the Phase 1 trade deal between the US and China. Since then, the COVID-19 virus has severely disrupted economic activity in China and is beginning to impact the global outlook.

This week we explain the concept of inflation targeting as a way to conduct monetary policy, compare inflation in major economies and argue that there remains considerable space for continued monetary stimulus.

Since the early 1990s, central banks have increasingly focused on inflation targeting to help both achieve and communicate their contribution to strong and stable economic growth via price stability.

Inflation-targeting central banks raise interest rates to cool the economy with the intention of lowering inflation when it is expected to be above target. Likewise central banks lower interest rates to help stimulate the economy, thereby boosting inflation when it is expected to be clearly below target.

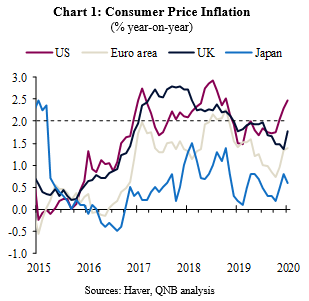

Here we use Consumer Price Inflation (CPI), to compare inflation across the economies covered by the four main central banks: The US Federal Reserve (The Fed); European Central Bank (ECB); Bank of Japan (BoJ); and Bank of England (BoE).

Inflation is quite volatile, even in major advanced economies. The volatility in CPI is often driven by changes in global commodity prices and particularly oil prices. For example, low inflation in 2015 was driven by the sharp fall in oil prices. However, central banks try to look through these so-called “first round effects” on inflation as global commodity prices are out of their control. Instead central banks try to focus on “second round effects”, the most obvious of which would be large changes in wages. Indeed, central banks often talk about the idea of anchoring inflation expectations. They hope that companies and individuals will then negotiate prices and wages based on an expectation that inflation will remain reasonably close to target.

Central bankers and economists had lived through decades of fighting too-high inflation when they set the current inflation targets in the 1990s and 2000s. More recently, central banks have struggled to push inflation high enough to meet their inflation targets. Indeed, they have had to resort to unconventional policy tools, including purchasing assets, which is often also called Quantitative Easing (QE).

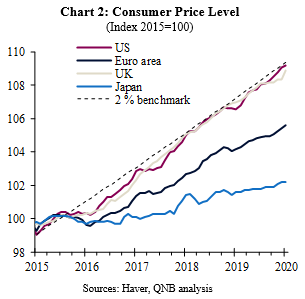

The Fed and BoE have been more aggressive with their use of QE, resulting in a level of Consumer Prices only a little below that implied by a 2% CPI benchmark (Chart 1). However, the ECB and BoJ have really struggled to stimulate the Euro area or Japanese economies enough to drive inflation back up and it remains stuck well below 2%. Persistently low inflation is even more apparent if we compare the level of consumer prices since 2015 (Chart 2).

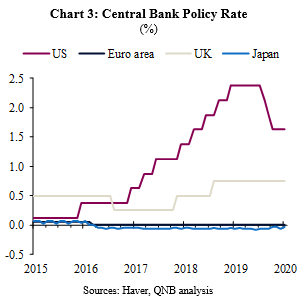

Stronger inflation in the US and UK even allowed the Fed and BoE to raise interest rates in 2017 and 2018, whilst ECB and BoJ interest rates were stuck at, or below zero (Chart 3).

The Fed was, however, forced into a dovish pivot and three interest rate cuts in 2019 by the US-China trade war and a manufacturing recession. Indeed, both the Fed and ECB are currently considering adjusting their monetary policy frameworks to give more policy space to respond to persistently low inflation. This is important as slow growth and low inflation mean that monetary policy will need to remain accommodative in most major economies.

However, as we have already argued, fiscal policy is becoming a more important way to stimulate economies and improve the economic outlook. Fiscal stimulus should focus government spending on high-return infrastructure and on investment in people. Alongside fiscal stimulus, structural reforms could be implemented to boost productivity, growth, and jobs in all major economies.

Download the PDF version of this weekly commentary in English or عربي