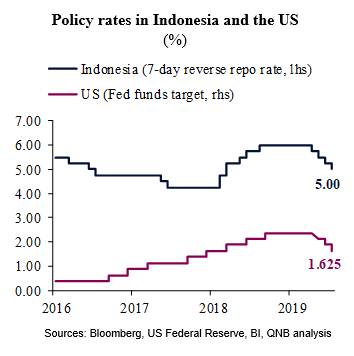

Bank Indonesia (BI), the central bank of Southeast Asia’s largest economy, decided to cut rates further by 25 basis points (bps) to 5% in its latest monetary policy meeting. The decision was in line with market expectations and amounted to the fourth rate cut since July this year.

According to the official statement, the easing is “a pre-emptive measure to stimulate domestic economic growth momentum.” The effort to support growth comes in response to a moderation in activity. In fact, GDP growth has slowed to 5% year-on-year (y/y) in Q2 2019, the worst performance in two years.

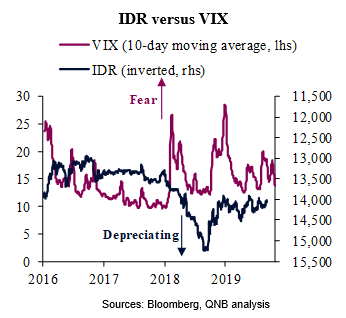

Global conditions this year have so far been supportive for Indonesia’s monetary authorities. This comes as a relief after a difficult 2018, when the US tightening cycle and bouts of risk-off sentiment forced BI to jump ahead of the curve and hike policy rates by 175bps. Indonesia’s monetary policy is particularly influenced by external conditions. The country runs twin deficits (current account and fiscal) and relies on foreign portfolio investments to close the financing gap. Moreover, non-residents hold 21% of total government securities issued in local currency. Thus, Indonesia is often pressured to maintain attractive risk premiums and asset prices. This takes place even when the economy is not over-heated and inflation is running on target.

This analysis delves into the four factors that have contributed to provide Indonesia with monetary policy space in 2019.

First, the US Federal Reserve (Fed) undertook its “dovish pivot,” cutting US policy rates on the back of a slowing economy and significant global headwinds. The 10-year nominal Indonesian Rupiah (IDR)-USD differential has widened to around 220bps above the 2018 low.

Second, despite ebbs and flows, positive developments in key risk factors such as the US-China economic conflict have improved the appetite of portfolio investors. The Chicago Board Options Exchange (CBOE) Volatility Index (VIX), often referred to as “fear gauge,” has eased significantly after two major peaks in 2018. This has re-ignited a search for yield that has reduced pressure on vulnerable emerging markets, including Indonesia. Net debt and equity inflows to Indonesia over H1 2019 stood at USD 11 Bn from a negative USD 4 Bn over the same period in 2018.

Third, the government has implemented several measures to improve its current account position, reducing the demand for external financing. Targeted policy measures included an expansion in the cap for coal production, a more selective approach to import-sensitive infrastructure spending, the front-loading of plans to mix domestic biodiesel into petrol, and the imposition of tariffs on more than one thousand consumer goods. This has reverted the multi-year trend of a worsening current account position; the deficit has improved from 3.6% of GDP in Q4 2018 to 2.8% in Q2 2019.

Fourth, inflation remained contained at 2.9% in H1 2019, well within the inflation target band (2.5-4.5%). Anchored inflation expectations and downside pressure in key administered prices more than offset the inflationary effects of higher food inflation and the 2018 currency depreciation.

All in all, we expect Indonesia’s monetary policy space to continue to increase over the coming quarters. As such, in the absence of a major reversal in risk sentiment, we believe the BI is set to cut rates further by another 50bps in 2020 to 4.5%, in line with additional easing from the US Fed, low inflation pressures and the willingness to stimulate domestic growth.

Download the PDF version of this weekly commentary in English or عربي