The European Central Bank (ECB) has decided to launch a new stimulus package at the latest monetary policy meeting of its Governing Council on September 12th. The decision came as the Euro area is affected by a negative macroeconomic backdrop. Adverse developments include a more protracted growth slowdown, lower inflation and the persistency of significant risks to the outlook, notably global trade tension, Brexit and idiosyncratic political risks in Italy.

The stimulus package announced by departing ECB president Mario Draghi encompassed four main measures. They included a cut in policy rates, the reinstitution of large scale net asset purchases or quantitative easing (QE), more attractive “targeted longer-term refinancing operations” (TLTROs) for banks, and stronger forward guidance signs to investors. Our analysis delves into each of these measures before discussing our views.

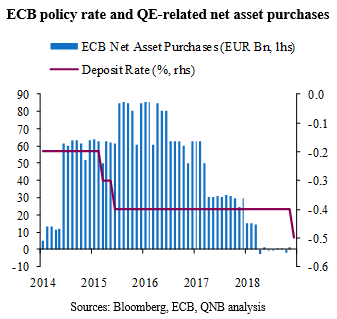

First, when it comes to policy rates, the ECB has decided to cut the benchmark deposit rate further into negative territory by 10 basis points (bps) to -0.5%. This rate cut was smaller than anticipated by markets but in line with our expectations. Importantly, however, the ECB has also announced a new tiered system partially exempting banks from paying for their excess reserves (due to negative deposit rates). This provides a significant relief for credit institutions as around EUR 800 Bn of the EUR 1,800 Bn of excess reserves is being exempted from negative deposit rates. By partially alleviating the pain of negative interest rates on banks, this potentially opens the way for further cuts down the line.

Second, when it comes to quantitative measures, the ECB has approved the reinstitution of QE. A fresh dose of EUR 20 Bn in net asset purchases per month is set to start in November this year. This will effectively end the short lived balance sheet normalization process that was announced late last year. The aim is to further ease financial conditions.

Third, when it comes to fostering credit growth, the ECB improved the conditions of TLTROs. Funding rates were lowered and maturity lengthened to 3 years from 2 years. The measure aims to further subsidize funding to banks that are willing and able to expand their loan books.

Fourth, when it comes to forward guidance or the use of communication tools to manage investors’ expectations, the ECB has significantly tweaked its message. Policy actions are now presented as open-ended and contingent to certain conditions rather than targeting specific time frames. As an example, the ECB has changed its guidance about the maintenance of current rate levels from “mid-2020” to a more dovish but somewhat vague target. Rates are now expected to stay at current levels or below until the inflation outlook converges to a level close to 2%. Similarly, the QE program is also open-ended. The official guidance suggests that QE should run for “as long as necessary,” eventually ending “shortly before” policy interest rates are lifted. In other words, as the ECB itself does not project inflation picking up in a more meaningful way before 2021, there is no policy normalization in sight.

All in all, our view is that the ECB is now very close to completely exhausting its monetary policy space. While we believe that policy rates will still be cut further into negative territory by another 10 bps next year, the scope for quantitative measures is smaller than the official guidance suggests.

Further purchases of public sector bonds are limited by implicit rules associated with Maastricht treaty provisions on ECB financing for member states. It is difficult for the ECB to buy more than 33% of any single bond as that would allow it to block decisions in debt restructuring negotiations. As the composition of asset purchases has to be proportional to GDP, the ECB is approaching its debt ownership limits to securities of a number of countries. With the new round of QE, the ECB will soon run out of eligible bonds to buy from Germany, the Netherlands, Slovakia and Finland. Potential alternatives to lift certain restriction and expand the scope of eligible assets for purchase under QE are likely to be limited by political constraints and a divided Governing Council. Therefore, in the absence of severe shocks, we expect the new QE program to end in less than two years or considerably before policy rate normalization starts.

Download the PDF version of this weekly commentary in English or عربي