China has been outperforming all major economies for decades, becoming one of the world’s most important growth engines. This pattern of Chinese outperformance has continued last year, as the Covid-19 pandemic ravaged activity across continents. In fact, China was the only major economy to present positive GDP growth in 2020, with the economy expanding by 2.3%, versus a contraction of 3.5% and 6.5% for the US and the Euro area, respectively.

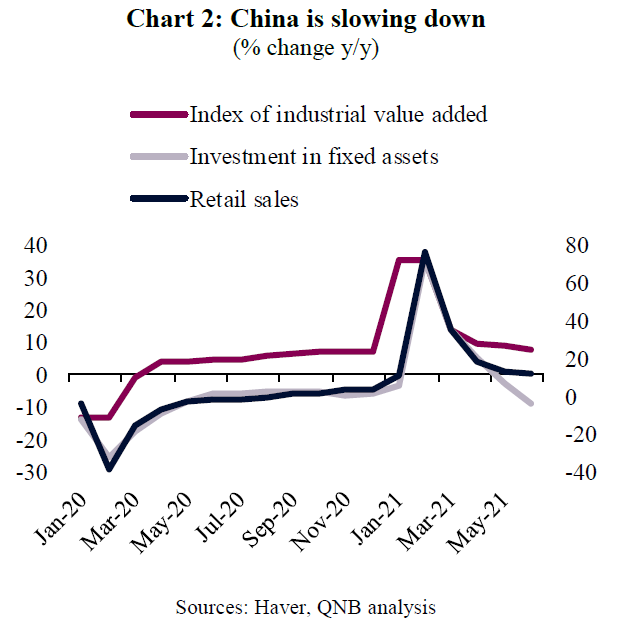

However, while the pandemic shock has been limited and short for China, followed by a quick recovery, there are strong signs that the economy is already starting to slowdown substantially. After experiencing a strong out-turn of 18.3% on a year-on-year (y/y) basis in the first quarter of this year, the Chinese economy decelerated to 7.9% in the second quarter (Chart 1). Importantly, the slow down has been broad, including several major components of the economy, such as industrial production, investments and retail sales (Chart 2).

Recent headwinds for the Chinese economy include the new Covid-19 Delta variant and floods across the country, which disrupted business activity. Another key element for the deceleration of economic activity has been the gradual withdrawal of policy stimulus by Chinese authorities. On the fiscal front, policy has tightened with less extraordinary benefits and social transfers as well as more moderate spending and support for public investments. On the monetary front, a slower growth of money supply is also pointing to a less supportive policy stance.

Despite all the headwinds, we do not expect China’s economy to slowdown sharply, beyond the policy target of GDP growth of “around 6%.” Three main factors underpin our view.

Despite all the headwinds, we do not expect China’s economy to slowdown sharply, beyond the policy target of GDP growth of “around 6%.” Three main factors underpin our view.

First, private consumption is expected to recover more strongly over the coming quarters, supporting a healthy re-balancing of the economy. While private consumption is expected to remain under pressure in Q3 2021, on the back of a wave of new Covid-19 Delta variant cases, a rebound is expected for the end of the year and into 2022 as the effect of the pandemic fades. Furthermore, Chinese authorities are supporting the re-balancing of the economy towards consumption and private sector engagement. Consequently, growth drivers are likely to shift from public-sponsored infrastructure investments to private domestic consumption. In addition, there is excess savings accumulated during the pandemic. The unwinding of the savings will also support private consumption growth. Therefore, despite hardly any growth in private consumption in 2020 and a lacklustre 2021, we expect private consumption to gain momentum and rebound over the next few quarters.

Second, as China’s growth drivers shift, private corporate investments are expected to partially offset the decline in public investments. As China’s infrastructure is already highly developed and additional public investments in the sector tend to be less efficient, often contributing to create inadequate levels of indebtedness and overcapacity, public investments are not a sustainable source of long-term growth. Therefore, they are expected to decline going forward and to be replaced by private investments, particularly in strategic manufacturing “frontier sectors”, such as artificial intelligence, quantum computing, semi-conductors, medical technology and space exploration, which includes satellite development and fundamental research. This will not only contribute to contain a sharper slowdown but also increase economic productivity over the longer term.

Third, China’s exports are expected to remain strong, supported by a benign external environment. After years of total exports ranging between USD 160-220 Bn per month, China’s exports reached an all time high of more than USD 280 Bn in June 2021. While export growth is set to moderate over the coming quarters, as the global recovery has likely peaked, the overall level of nominal exports will remain elevated, as external demand gradually normalizes.

In short, growth of the Chinese economy is slowing. However, it is worth noting that the Chinese economy has passed its peak with fiscal and monetary stimulus fading. As such, we consider this current growth trajectory as a normalization, still at high growth levels. We therefore do not expect to see activity to slide below the growth target of around 6%. Private consumption, manufacturing investments and exports are likely to support the gradual slow down of the Chinese economy to a more normal pace. Thus, we expect China to grow by 8.1% in 2021 and 5.5%-6% in 2022 and 2023.

Download the PDF version of this weekly commentary in English or عربي