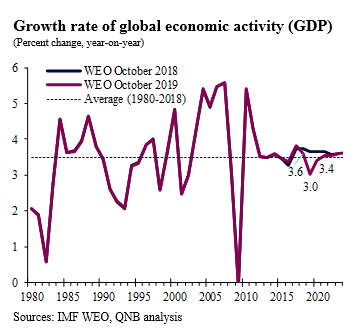

In its latest World Economic Outlook (WEO), the International Monetary Fund (IMF) forecasts a synchronized slowing in the growth rate of global economic activity (GDP) to 3.0% in 2019 from 3.6% in 2018. Indeed, the IMF has been steadily revising down its estimates and forecasts for global GDP growth over the past year (see chart).

However, the IMF expects a modest recovery in 2020 with global GDP growth picking up to 3.4%, driven by recoveries or shallower recessions in a number of large emerging markets that experienced particularly weak growth in 2019.

The increased trade protectionism is the main driver of the slowdown in 2019, which is concentrated in the manufacturing sector. However, activity in the services sector has held up well, so far, supported by monetary stimulus.

A key driver of the slowdown is trade protectionism. Specifically, the IMF estimates that the negative impact of the trade war between the US and China will lower the level of global GDP by 0.8 percentage points (ppt) in 2020. However, trade protectionism is a more general problem. Tensions between Japan and South Korea have risen during 2019, as have tensions between the European Union (EU) and the US. EU and Japanese politicians have been working hard to keep their substantial automotive exports to the US out of the spotlight. The automotive industry is currently contracting due to persistent disruptions from new emission standards in the EU and China.

More generally, manufacturing and global trade are suffering from a broad-based slowdown across the whole world that goes beyond the big-4 economies (US, EU, China and Japan). Trade protectionism has hit business confidence, leading to weaker investment. Global trade flows are concentrated in manufactured capital goods. Therefore, it is not surprising that, at only 1%, the first half of 2019 saw the weakest growth in global trade volumes since 2012.

The services sector has so far managed to hold up, as has employment and wage growth. In addition, low global inflation has given central banks across the world space to ease policy significantly resulting in lower global interest rates. Together, these factors support income growth and consumption, which remains the main driver of growth in many countries. Indeed, the IMF estimates that monetary easing will boost global GDP growth by 0.5 ppt in both 2019 and 2020. That said, concerns are mounting that the slowdown in manufacturing will eventually undermine the strength of the services sector.

The IMF expects a modest recovery in 2020 driven by a stronger growth in a number of large emerging markets. Brazil, Mexico, Russia, Turkey and Saudi Arabia, are all expected to grow by about 1% or even less in 2019 due to a range of idiosyncratic factors. The IMF assumes that these factors are not particularly persistent, and hence forcasts stronger growth for all these economies in 2020.

In contrast, GDP growth in the big-4 economies mentioned earlier is expected to weaken further in 2020. These big-4 economies together account for nearly half of global GDP. They also help stimulate growth in the rest of the world, particularly via demand for imported commodities and manufactured goods. It is therefore, hard to see how growth in the rest of the world can pick up so strongly at the same time as growth weakens further in the big-4.

In conclusion, perhaps the IMF’s latest WEO projections are too optimistic? Indeed, we would not be surprised if growth weakened further in 2020 before a more gradual recovery than the IMF expect.

Download the PDF version of this weekly commentary in English or عربي