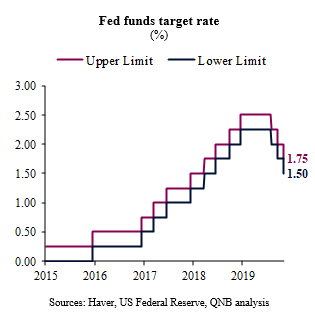

The US Federal Reserve (Fed) has decided to cut rates for the third time this year at its latest monetary policy meeting in October 29-30th. The target range for the benchmark fed funds rate was adjusted down by another 25 basis points (bps) to 1.5-1.75%. Stated reasons for the cut included “the implication of global developments for the economic outlook as well as muted inflation pressures.” This decision was widely anticipated.

Forward guidance from the official statement and the post-meeting press conference were moderately hawkish. The previous line about acting “as appropriate to sustain the expansion” was substituted by more ambiguous language about assessing “the appropriate path of the target range for the federal funds rate.” The characterizations of growth, inflation and risks to the outlook remained essentially the same. Moreover, regional Fed presidents Esther George (Kansas City) and Eric Rosengren (Boston) reaffirmed their hawkish dissent against the decision to cut rates further.

Three main factors help explain the Fed’s moderately hawkish statement and the space for a pause before incoming data points to a more clear direction for the US and global economies.

First, investor sentiment has improved significantly in recent weeks, which eased financial conditions and created a more supportive climate for risk taking. Despite ebbs and flows, developments in key risk factors such as global trade conflicts seem to have taken a positive turn. As a response, the Chicago Board Options Exchange (CBOE) Volatility Index (VIX), often referred to as “fear gauge,” has plummeted. Similarly, CNN’s Fear and Greed Index, which collects several indicators to estimate the emotions driving investor behavior, moved from “fear” a month ago to “extreme greed” at the time of writing.

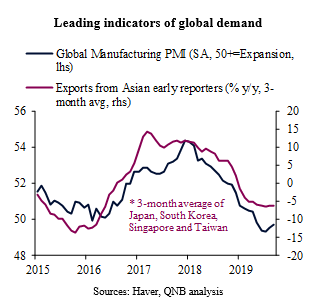

Second, leading indicators of global demand started to show more persistent signs of stabilization. The Global Manufacturing Purchasing Managers’ Indices (PMI), for example, have bottomed in May 2019 after falling for several consecutive months. Currently at 51.2, the PMI is still above the 50 threshould that separates contraction from expansion. More importantly, exports from Asian early reporters, a key gauge of global activity, are finally stabilizing after almost two years of slowdown and even some decline. This is a key input for US policymakers as battered global conditions are often presented as one of the main reasons behind the need for further monetary accommodation.

Third, market based early warning indicators have also eased, moderating the implied probabilities of a recession over the short-term. As investors rotate from safe-heaven bonds to riskier assets, several of the US government yield curves have returned to positive territory after inverting. This includes the benchmark spread between the 10-year Treasury notes versus the 3-month bills. Inverted yield curves historically signalled a coming recession a year or two in advance. In addition, equity market internals or market breadth indicators have also improved. The S&P 500’s recent all-time highs seems to have a stronger base as market internals are more synchronized and trading volume data also supports overall stronger market breath.

But the US economy is not out of the woods yet. Leading indicators for real domestic activity, less prone to quickly respond to sentiment, are still weak. The ISM PMI is still in contractionary territory at 48.3 with new orders recovering a touch but also below the 50 expansionary threeshould. While the unemployment rate is still at multi-decade lows, hiring activity (payroll addition) is worsening and aggregate hours worked for the private sector is diminishing.

We believe risks to the US outlook continue skewed to the downside, especially as the electoral political agenda kicks in early next year. The US Fed remains divided and will continue to be data-dependent, acting reactively instead of proactively. The ongoing US economic slowdown and downside risks to sentiment are likely going to push the monetary authorities to ease again in 2020. Therefore, we believe that the US Fed is only set to a pause for breath, rather than having completed a “mid-cycle adjustment” in policy rates.

Download the PDF version of this weekly commentary in English or عربي